Application Exercise 4g: ‘Wall St’ the movie

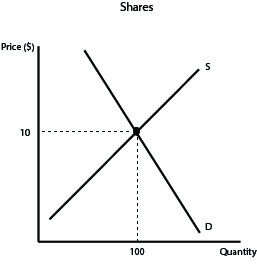

1) Investors demand the shares and become shareholders, while companies and existing shareholders sell (supply) the shares. As the price of shares decrease, Investors are more likely to purchase the shares at this cheaper price in expectation of a greater return or capital gain). As the price of shares increase, existing shareholders are more likely to sell their shares to enjoy a capital gain upon the sale of the shares.

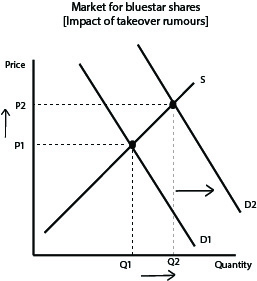

2) The demand for BS shares will immediately increase because investors realize that the organization seeking to takeover BS will need to buy all the shares in the market, which bide the price of BS shares upwards.

3) Gecko is definitely a capitalist: because he is driven to make more and more money in order to increase his personal fortune.

4) Fox and Wildman spread rumours that BS was the subject of a takeover bid, forcing the price upwards. Gekko was then forced to pay lots more money for the BS shares. Then Fox ensured that the unions made it clear to Gekko that BS assets (e.g. planes, hangers, reservation systems etc) would be sabotaged and that their value would plummet. Gekko was then forced to sell the shares just at the time that Fox alerted the market that the takeover rumours were false (e.g. he encouraged clients to exit BS shares and the price dropped heavily resulting in huge losses for Gekko.

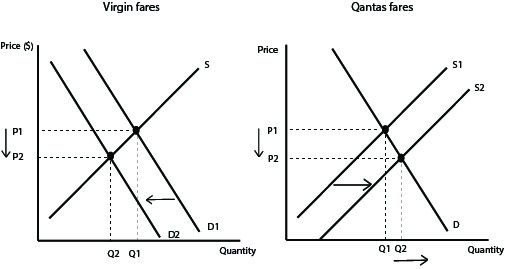

5) The resources will move from Virgin to Qantas, including the workers, equipment, airplanes, etc. This is illustrated in the diagrams below.

6) As illustrated in the diagrams below, the supply curve shifted to the right because Qantas was more efficient, thus enabling the price to fall, which resulted in higher demand for Qantas flights. As a consequence, the demand for Virgin flights dropped, causing less Virgin flights and fewer resources allocated to production at Virgin. Prices at Virgin will need to fall in order to remain competitive, but unless it improves efficiency over time, it is likely to ‘go broke’

7) This is to ensure that we have a ‘level playing field and those investors have maximum confidence in the safety efficiency and stability of the financial system. For example, it insider trading was not illegal, then potential share investors would be deterred from investing in the market and instead put their money somewhere else (e.g. in plupeily). This would effectively reduce the di nunt of money for companies lu invesur expand and effet lively distort the allocation of resources.

8) In the context of share markets, insider trading occurs when entities trade in shares on the basis of confidential and make sensitive insomnia lion that is not known to be general public. The winners from inside trading is anyone who possesses the inside information and acts accordingly to their own advantage by buying shares they know will increase in price or selling shares they know will decrease in price. The losers are the majority of investors who don’t possess the Inside Information. For example, the existing holders of the shares who sold them to the inside traders will lose out because they will not be the ones making a profit on holding the shares once the market responds to the information when it heromes public knowledge.

9) Insider trading is illegal because it reduces the efficiency of the financial system. Investors will lose confidence in the integrity of the share market and it will hero me a much less extortive and more Lusty means by which companies will be able to source funds for investment expansion.

10) The response to this question will vary from student to student.

11) By making people believe that any owned by garden Gekko must be valuable, he has created that it is valuable.

12) a) This huge inequity in wealth distribution may have arisen for the following types of reasons:

- An imbalance in skills and talents of people (e-g. some are highly educated and can earn more)

- Inheritance of wealth

- Hard work

- Risk taking/entrepreneurial-ism

Some inequity is a good thing because it helps to drive entrepreneurial spirit and helps to create more production and stimulate growth in Incomes and wealth. However, huge Inequity is not Ideal because it plants the seeds for discontentment that results in reduced levels of social cohesion that can manifest if crime or even revolutions.

b) Some government initiatives (policies) that could be used to reduce the level of inequity in the distribution of wealth are as follows:

- A progressive tax system, where higher income earners pay a higher rate of tax compared to lower income corners

- The provision of welfare payments for low income earners

- Subsidies given to lower Income earners (e.g. pharmaceutical benefits transport

13) First, the unions captured Gekko’s interest by promising to make the airline a viable competitor in the market place by agreeing to wages cuts and increase in productivity. Second by walking into Cokho’s office and threatening to sabotage the assets if he continued through with his plan to purchase the airline and sell/liquidate the assets.

14) The nature of the agreement between Fox, Gecko and the unions was that the unions would agree to a 20% pay cut in addition to working more hours, on the provision that these concessions would be returned if or once the business returned to protitability. The three point plan (greater advertising, modernization and more routes) was also Part of the agreement.

15) The meaning of following terms/expressions/phrases used during the movie are outlined below:

“We’re in a BULL MARKET here….” : When the prices in markets are increasing.

“the breakup value is twice the market price” (Gekko): When the company is ‘liquidated’ and all the assets are sold, the value that would be gained (1.e. the selling price) would be double the value of the total shares in the market place.

“I’ve bayed the elepliant’ (Fux): When Bud finally gels Gudrun Gekku’s business (secuies in as a client)

- “No one’s goanna blow the whistle on you” (Gekko to Fox): No one will advise the authorities (you will not be dobbed in/ratted on’)

“Every battle is won before it’s even fought” (Gekko): It means that the person who is most prepared for battle is likely to be the victor. In Gordon’s case, he ensured that he won every battle by trading in insider information’

“I want to rebuild Anna cot Steel rather than liquidate it and you’re getting a free ride on my tail”(Wildman To Gekko): It means that Gekko knows that Wildman’s interest in the shares will push up the price and so he buys the shares knowing that he will eventually make a profit by selling to Wildman.

“I could dump the stock to burn your butt” (Wildman to Gekko): Wildman is saying that he could sell his holding in Annacot Steel, which would drive the price down and result in Gekko making losses when he sells his shares in the company?

“Do you wonder why fund managers can’t beat the S&P 500 (a stock market index like Australia’s All Ordinaries Index)? Because they’re sheep and sheep get to Fox): This is a recognition that share market movements typically reflect herd mentality, where investors will typically follow the lead of the market (e.g. if the market is falling investors will sell shares and if the market is rising they will buy shares). In this respect, the herd mentality drives prices up to excessive levels (above the fundamental value of the market) during periods of rising prices. [The reverse occurs during periods of falling prices.] The problem with this approach is that booming markets eventually crash and the investors getting hurt ( slaughtered) are the most recent ‘members of the herd’ entering the market.

“Spread your buy orders over different accounts and you won’t get hurt” Gekko to Fox): Don’t buy the shares from the one account because it would invite suspicion from the authorities. Buy shares from several accounts and it becomes less noticeable and obvious.

“Greed, for lack of a better word, is good…….greed marks the upward surge of mankind” (Gekko at AGM of Tender Paper): Gekko argues that Greed helps people to make money and create wealth as they produce goods and services that not only create jobs but ultimately leads to better (material) living standards. The drive to create bigger stockpiles of wealth can lead to innovations and developments that ultimately lead to ever increasing advances in our quality of life.